The Big Picture…

Service, as we know, is the application of skills and competencies for the benefit of a party. And it is achieved by integrating specific resources owned by the involved parties (in the effort to co-create value).

This foundational principle introduces a couple of things. Firstly, it introduces the concept of actors. It does so to abstract away from the “them vs us” terminology underlying terms such as provider/consumer, B2C, B2B, C2C etc. As well as conveying the common network nature of service provision. Every party involved in the service is simply an actor.

And secondly, it introduced a potential explanation as to why organisational boundaries exist. That question is traditionally answered by pointing to Transaction Cost Economics (Coarse/Williamson). This premise views that organisations are a useful construct. Integrating and transforming micro-specialisms into a more complex service. For which there is market demand.

This turns out useful as we should consider a firm is made of internal service – and they should be beneficiary oriented, relational, help the beneficiary make progress, etc.

But it was quickly noted that it is not just firms that integrate resources. Every actor – from individuals to households to firms and on to social organisations – does. And so, we now see that all economic and social actors are resource integrators.

Perhaps a future update will use the term “service systems”. That was discounted in 2008’s definition as “service systems” was too unknown at the time. But I feel the following definition conveys all the above, cleary:

All service systems, including the beneficiary, are resource integrators.

The 9th premise

We know that service occurs when entities integrate their resources, based on an attractive value proposition, in order to follow through a process of co-creating value.

In the initial description of service-dominant logic foundational premises (2004), there were only 8 of them. Though a 9th was introduced in the 2006 paper looking at what service-dominant logic is, what it is not and what it might be.

This initially looked at why organisations exist, before a swift realisation that organisations are not the only resource integrators, but that that is what every actor is involved in. And we’ll look at all this plus why the word “actor” was chosen. As well as why, perhaps, “service systems” might now be a better choice.

Why do organisations exist?

One “what it might be” was a thought that service-dominant logic might help describe why we have organisations (e.g. firms).

Organizations exist to integrate and transform micro-specialized competences into complex services that are demanded in the marketplace

The original 9th foundational premise, in Vargo & Lush (2006) “Service-dominant logic: What it is, what it is not, what it might be“

And this is not an unreasonable thought. Think of any organisation, and through a service-dominant logic lens, it is an integrated set of services. Typically there are sales, marketing, accounting, delivery, etc services. Each service is made up of individuals with micro-specialisations. And the firm integrates all those together to provide an external service.

In IT terms you could look at this as the firm’s service being a facade to all the background services it integrates. Some, or parts of, those internal services are visible to the outside world; but the externally seen functionality hides complexities and provides the appearance of new functionality.

A new theory of the firm?

If we turn this around, we can say that an entrepreneur sees a market opportunity for a particular (complex) service. That is to say, the entrepreneur believes, firstly, that they can create an attractive value proposition. And, secondly, to deliver on this value proposition, they need to integrate several micro-specialisations. And so an organisation is formed.

I believe this is a useful view. Because it gets us thinking of the internal aspects of a firm as services. And therefore that internal service should be beneficiary oriented, relational, and help beneficiary make progress etc.

However, we need to think of an additional, middle, layer between micro-specialisations (i.e. individuals and their competences) and complex service. For example a finance or marketing team. At this level, traditional transaction cost economics is still relevant. As an entrepreneur, I could have my finance team in-house, or I could buy in the service, or align with an actor.

Transaction cost Economics

The main thinking about why we have firms is based around transaction cost economics. (Coarse’s “The nature of the firm“, Williamson’s “Transaction-Cost Economics: The Governance of Contractual Relations” etc).

In short summary, it’s all about the hassles of haggling to get a deal and the impact if another party won’t deal with you. We find it is easier (cheaper transaction cost) to make things ourself if we are likely to be held hostage by another entity. And we buy things when the hostage risk is low. A middle ground is to form an alliance to get what you need. Giving rise to the phrase “make, buy or ally”.

Opportunities for being held up come from:

- uncertainty – do we know what we want to purchase down to precise details?

- how frequently is the purchasing – if frequent, we might want to make, if unfrequent the cost of being able to make ourselves might outweigh buying

- specificity – is it a generic thing we can buy from many places, or a unique thing with limited, perhaps only one, supplier.

- bounded rationality – there are limits on humans understanding every situation

- opportunistic behaviour – a proportion of people will opportunistically take advantage of bounded rationality

These, I argue, are still all valid when looking at what service should be inside the organisation’s boundary (make), which can sit outside (buy), and which are best to be sourced through an alliance.

As an entrepreneur, I could relatively easily buy my accounting team as a service instead of having in house.

IT Outsourcing and co-destruction of value

And it has been quite typical to outsource IT service over the last decade or so. The challenge here is it often encourages a value-in-exchange mentality at contracting level – driving the “provider” behaviour. Whereas, paradoxically, the purchasing party often expects a value-in-use approach, despite what they have contracted for. In my experience, this discrepancy leads to value co-destruction.

But, let’s swing back to the foundational premise.

All actors not just organisations

Very quickly (“before the ink was dry” note Vargo & Lush) it was that it wasn’t just organisations that were resource integrators. Individual beneficiaries were also. And actually it turns out that everyone involved with the service is integrating resources.

And whilst this was noted in the “reactions, reflections and refinements)” paper, it was not updated until 2008’s “service-dominant logic – continuing the evolution” paper. Now we have the final version of the foundational premise:

All economic and social actors are resource integrators

Foundational Premise #9, Vargo & Lush (2008) “Service-dominant logic: continuing the evolution“

Why Actors?

Vargo & Lush carefully chose to use the word “actor”. You will find, in other definitions of service, the likes of provider/consumer or supplier/customer, etc. They felt that promotes a goods-dominant view where one entity creates, and another consumes value. Whereas in service-dominant logic we co-create value.

“Actor” is also a helpful abstraction in anonymising who is involved. We talk of actor-to-actor interactions (A2A) and are free of needing to say if that is business-to-business (B2B), consumer-to-consumer (C2C) or business-to-consumer (B2C).

Vargo & Lush also believe this reformulation highlights the network nature of service provision:

networks are implied in the original FP9…but becomes more apparent in its almost immediate restatement —“all economic actors (e.g. individuals, households, firms, nations, etc.) are resource integrators.”

Vargo & Lush (2008) “Service-dominant logic: continuing the evolution“

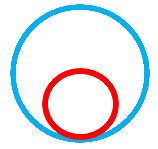

It is clearer when you draw it, as in Figure X. But maybe not so much more just in the text.

What about Service Systems?

I have one final point. Vargo & Lush chose actors as the entities but did note that “Alternatively, “service systems” might be a good, S-D friendly term” (in “continuing the evolution”). I agree with them that it would be good as a system implies networks better than actors.

And Spohrer et al define a service system as

service system a system where entities exchange performance of beneficial action

Spohrer et al (2007) “Steps towards a science of service systems“

Which neatly fits our narrative. The word remained actor though, as “we suspect [service system] is not yet sufficiently familiar to marketing scholars and practitioners.”

Maybe it is time to revisit that. The following reformulation, in my humble opinion, makes a lot more sense to me:

All service systems, including the beneficiary, are resource integrators

Wrapping Up

There we have it. A foundational premise that promised a lot – Williamson’s work on transaction cost economics got him a Nobel memorial prize in economics. This turns out to not be so earth shattering, but gives us a good insight into why we should consider service internal to a firm.

It also informs us of the network nature of service provision. And that everyone involved is integrating resources. Our on-line shop example gives a fine example of this in action.