[Work in progress]

Why are you innovating? It may seem a strange question to ask, and at a high level has an obvious answer: to make more money. But it is often not as simple as this, and by misunderstanding why you are (need to be) innovating you risk wasting efforts.

Key take-aways

- be clear on why you are innovating, as it focuses your approach and success criteria

In part two of this article (not written yet) I look at the reasons an organisation innovates from a perspective of strategy and other factors. This article focuses on five different organisations types, a:

- A product company

- A services company

- A social entrepreneur

- A digital native startup

- IT consultancy (as an example of a technical knowledge intensive business services (t-KIBS))

We explore why these organisation types need to innovate, and that the reasons behind this need are different.

This difference is important to understand. Say you are a services company (or operating in a service economy) then performing innovation as a product company is going to lead to innovation performance unhappiness.

Introduction

As we saw in the innovation problem, 94% of executives are unhappy with innovation performance.

We also saw that over 60 years ago the father of management consulting, Drucker, noted that a company exists to get a customer. To do that, the company has only two functions: marketing and innovation.

Under this thinking, innovation (as a process) naturally gets interpreted as coming up with at least the first two of the following:

- enhancements to an existing product – such as adding even more blades to a razor blade

- developing a new product- for example a new way to remove unwanted hair

- finding a way to enrich, enhance, enable a customer’s entire experience (for example: remove pain points such as shopping through developing a subscription delivery service of razor blades)

We can view this as very much focusing on revenue growth. This is fairly obvious since if an organisation does not enhance its offering over time, then there will be a natural decline in sales. A decline in sales means a decline in revenue, and so a decline in margins, leading to an unsustainable business.

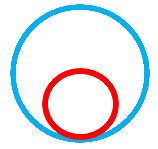

[Image of innovation for revenue growth and cost reduction]

But, as we see in Figure 1, innovation is equally applicable to cutting costs. Over time any organisation doing the same thing repetitively will find cost efficiencies. We can use innovation to make more aggressive efficiencies. There are fixed costs to challenge such as factories or office space; variable costs such as personnel or machinery; and sunk costs.

[proportions of fixed, variable and sunk costs are different for different company types. A product dominant company should have higher fixed and variable costs compared to a services-dominant one (which should have higher sunk costs). Of course, there is the product-service continuum so we can’t be so absolute in our definition…

[diagram, probably stack chat with product on left and service on right; shows proportion of fixed, variable and sunk costs; under x axis is representation of product-service continuum]

Product-dominant

A car manufacturer has a range of options to reduce its fixed and variable costs.

To produce the car the manufacturer needs at a minimum an assembly plant and labour. It can relocate that to a location with lower labour and/or real estate costs.

If the company produces its own parts – also requiring factories, machinery and labour – it can look to buy them from a company that is more efficient, perhaps that company makes parts for multiple other manufacturers – rather than making themselves. They could also ally with other car manufacturers on basic design of cars and only tweak a small part to be specific.

There are a host of other activities it could do, which we look at in part two, around strategy and Porter’s value chains.

Service-dominant

Banks are a good example of what service-dominant companies can do. Years ago each high street had several banks in buildings on it. These are relatively high cost, but we’re necessary when money truly was physical. These dominant buildings signaled safety and accessibility.

In later years, with factional banking and computers, we know money is not really stored in the banks physical buildings. This has driven the banks to cut their fixed costs by leaving these buildings and moving to online call centres. Variable costs were cut by moving those call centres to lower cost labour markets, and increasing user of online banking.

[Comment on customer resistance, moving call centres back, a special feature of services]

But, we have to recognise there are few organisations that are pure product or pure services, there is a continuum between these.

Somewhere inbetween

A restaurant is a good example of an organisation that sits somewhere between being product- and services-dominant.

needs to focus on variable costs or providing an out of this world experience]

Now we already start to see the main point of this article: different types of company should focus innovation efforts on different aspects. We will consist