Let’s look at Electrolux’s latest robotic vacuum cleaner. Which, in the Swedish market, has been released as both a product and a vacuum cleaning as a service. It is this service that we will explore.

We are in a relentless march towards service economies (or better put: towards exposing the true basis of economy is service) In 2017 the UK’s economy was reported as 79% service-based (14% production and 1% agriculture). Nigeria, as another example, reported an increase in GDP from services from 50% in 2010 to 55.8% in 2017. If you focus only on products, it looks like a bleak future.

We’ll position the service on the product-service continuum. And, we’ll explore which of the reasons behind the ongoing shift to the service economy are behind Electrolux’s service.

Electrolux robot cleaner

First, here’s a quick introduction to the product.

If you want to, you can be traditional. You can buy and own Electrolux’s Pure i9 robot vacuum cleaner.

But here on the Swedish market, there is an alternativ. Electrolux has recently introduced a floor cleaning service (link is in Swedish) around this product. Now you can use, and pay for, the Pure i9 the way you would hire a human cleaner.

Robotic Vacuum cleaning as a service

For the cost of 1 Swedish Kronor (around 10 euro cents) per square meter, Electrolux will send you a device that stays in your apartment. Through an app, you choose how often you want it to clean and the size of the area to clean. You can pause usage when on your long summer holiday hiking in the mountains. Or schedule an extra clean the morning after your unscheduled dinner party. Having an unexpected date coming around your place this evening? It’s simple to give your place an extra safety clean before you get back. And you pay monthly only for what you have cleaned.

Electrolux monitors the health of the device remotely. Which means a free service kit arrives in the post when needed. And, if the device stops working, they know, and a replacement is on its way. They will also take care of old units in a safe and environmental way.

And there is no binding time, only a circular-economy fee for cancellations within 18 months. A fee, which Electrolux says, goes to refurbishing units that are returned early so they can be re-used by another subscriber.

Let’s look at why providing cleaning as a service might just work. We’ll look at this in two ways. First the old school view where products and services are distinct – where we see a shift to service economy through a shift along the goods-service continuum. And then the new way using service-dominant logic – where principally, for this example, the product is a way of transporting the service of cleaning. Along the way, we’ll look at which reasons under-pin why the take up of a service can gain traction.

Shift to a Service

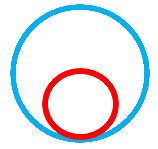

As a pure product, the robot vacuum cleaner is clearly on the left of the goods-service continuum (see Figure 1).

Where would we place Electrolux’s vacuum cleaning as a service? Well, to me, it is one step to the right of the product. It is not a pure service – far to the right – as there is still a product involved. The question is then: is it a service with supporting product(s) or a product with supporting service(s).

Conceptually, I see the value proposition is very much focussed around the tangible product: the robotic vacuum cleaner. Electrolux are selling you the cleaner that can be used as a service. To which supporting services – a mobile app to schedule cleaning, health monitoring, and timely provision of service packs – have been added.

Rather than it being a service with supporting products. An example of that would be if the cleaner was shared amongst several people and you scheduled the use of it. Or if Electrolux positioned their sales towards professional cleaners who then use it in their service provision.

Whilst not common in the traditional approach, we can already start thinking of what is the service trying to do. What is the job to be done it is being hired for. Or what problem is it solving / hinderance it is minimising or removing. Christensen’s job to be done theory talks about the big hire – decision to use – followed by little hire(s) – the decision to reuse.

So we can see it is a step away from pure product thinking. And now we will follow the reasoning as to why the market might be more accepting to a service than a pure product.

What opens up this shift to Vacuum Cleaning as a Service?

Let’s think about what enables this apparent shift. Here, in figure 2, we can see the 4 general categories behind the shift to service economies. These are economic, user behaviour, asset and use of data. Along with the more specific reasons.

For the robotic vacuum cleaning as a service neither of the economic reasons – de-industrialisation or cost disease – can be seen as directly relevant. There is neither a move of manufacturing abroad nor a productivity increase in the manufacturing industry driving this shift. Indirectly they may have an impact. But that is not obvious.

Rather, Figure 3 shows those reasons we can argue are underlying this particular shift.

Let’s explore each of these in turn, starting with the hierarchy of needs.

Hierarchy of needs changes

As disposable income increases we have greater choice over how we spend our time. We can afford more things that save our time. And between 2011 and 2019 the average annual disposable income in Sweden grew nearly 20%, from 413KSEK to 490KSEK (source: statista).

But this change just suggests that Swedes should be more open for a cleaning service over spending time cleaning themselves. And there are many options for this. Including purchasing the the robotic product itself. Since we just turn it on and let it clean, we don’t need to spend our precious time.

What pushes more to the idea of vacuum cleaning as a service is when we pull in job-to-be-done thinking. And in particular, the concept of big and little hires. The big hire is the initial decision. And Electrolux’s service addresses this by reducing the up-front cost. But perhaps more importantly, they also address the little hires – those repeated decisions to use the cleaner – by removing the hinderances to use. They minimise the time you have to waste maintaining the product. And they do that by monitoring use and pre-emptively sending maintenance packs.

Exogenous Demand Shock

Whilst disposable incomes are increasing, the number of households that have “spare” resources are reducing. Fundamental shifts in the structure of society and how we live mean time is more precious. More people are living a single life, or if in a couple both are busy. Or even single households with children. Long gone are the days of servants, and then later the housewife, spending all day at home cleaning the floor.

Just like the previous reason, the product itself addresses aspects of this reason. But by additionally turning it into a service Electrolux removes the time needed to maintain (hinderances to the little hires).

Changing notion of ownership

This reason is relatively obvious. Why do I need to own the product with it’s high up-front costs and ongoing hassles of maintenance/upkeep? The alternative is renting it for a smaller monthly fee where someone else monitors the health and looks after maintenance.

But let’s also be realistic. Offering as a service, where the beneficiary reduces ownership (and therefore cost) means that financial risk sits with someone else; Electrolux. Typically you would have a minimum commitment time or termination fee to manage that risk. Electrolux cleverly talk about having neither of those. Instead they charge a recycling fee if you end the service before a set time. That is used to refurbish the unit for the next user of the service. Now, realistically that is termination fee. But it is cleverly worded to imply the beneficiary is co-creating value (recycling, saving resource etc) even when ending the service.

Differentiating product

There are several robotic vacuum cleaners I could choose from on the market. Until now I would base my choice on product capability, price and what value I perceive at purchase time.

Now, the same aspects as above, help to differentiate Electrolux’s product in news ways. Low initial cost; pay for use; maintenance is taken care of, etc.

Leveraging Data

Service innovation shifts from the predominantly product logic thinking of value-in-exchange to value-in-use/context and to co-generation of value. This change supports the leveraging of data that can now occur. Let’s break this into the value from data Electrolux gets, and the value the customer gets.

Data Value to Electrolux

When selling a product Electrolux gets valuable data such as the number of and location of sales. Further, if the customer fills in warranty documents they may get some insight into the customer itself. And, if the product is returned as faulty, they can get some insight into product problems. But, what happens in between is a complete black box.

By running the solution as a service, Electrolux gets insights into how and when a consumer is using the device. They can observe if users start slowing down or increasing their use of the device. We could assume that people who are heavy users are likely to be very cleanly focussed. What up-sales can be made to those?

Through monitoring the health of the device, Electrolux gets early insights into potential product problems.

Data Value to the consumer

Consumers get value from data by knowing how often they are cleaning and how large a cleaning area they are servicing. Let’s say I use the service to clean my 67m2 apartment once a day. I could experiment and with cleaning once a week. If I see no noticeable difference in cleanliness then I am using data to free up money.

I can also experiment to clean heavy use areas more frequently than less frequently used. For example, the hallway could benefit from daily cleaning with all the people walking through it to get everywhere else. Whereas a couple of the rooms are rarely used, and so don’t need cleaning so frequently.

What’s the service-dominant logic view?

I’m very much of the view that taking a service-dominant logic view of the world is key to solving the innovation problem. So, how does that get reflected here?

A key aspect of service-dominant logic is that there is no value embedded in the offering. There is only a value proposition. And this is because value is uniquely and phenomenologically determined by the beneficiary.

The Service

There are two services here. First, we would observe that goods are a distribution mechanism for distributing service. And in practice, that means that Electrolux have frozen their cleaning skills and competence into the vacuum cleaner (product) during manufacture. Doing so, enables those skills and competencies to be transported, through a supply chain, to the beneficiaries physical location. The beneficiary then unfreezes those same skills and competence, applied together with their own skills and competence, every time the vacuum cleaner is used.

Secondly, Electrolux add additional service to enhance that base service. The health monitoring; sending service packs just in time, etc.

We can describe these services in our enhanced service as characteristics model as follows.

[image showing characteristics involved]

Where we can see that Electrolux bring technical characteristics to the service. That is to say their knowledge and competence of vacuum cleaning embedded in the physical goods involved. But also the beneficiary brings competence. They need to know how to use the device. And where they want to use it. As well as making sure it can be used where/when they want (is the area free, for example, of items that would prevent the cleaning from happening/working).

As part of the final characteristics, in my enhanced model, I have broken out what progress does the beneficiary make. This is a crucial part of the value proposition. And we can start identifying that by looking at the values the service proposes to address.

Potential Values

In their 2016 HBR article, Almquist, Senior and Bloch listed a hierarchy of elements of value.

So what values are Electrolux proposing to make progress with? Well, let’s take the physical product first – which remember is a means of transporting a service. The potential value to be created are mainly at the functional level. There is a potential to save time and reduce effort. And we could potentially argue there’s an element of informs – in that you know what has been cleaned and when.

At the emotional level, the basic service offers potential for increasing wellness. I may feel better knowing that my vacuuming is happening. And my anxiety may reduce for similar reasons. I personally struggle to see any life-changing or social-impact level values offered by this service. But, as I said, value is uniquely and phenomenologically determined by the beneficiary – so others might.

Looking at the enhanced service, we see a few more values potentially addressed. First there is reduced cost – at least in terms of upfront costs as you no longer purchase the product, rather a smaller monthly fee. There is an offer to avoid hassles, such as getting service packs sent to you just in time.

Additionally, a couple of value propositions are enhanced. Informs proposition is likely improved as the mobile app shows you how often the service is used, when it is scheduled next, and what areas are being cleaned (plus the cost). And positioning the early return fee as a refurbishment fee rather than minimum commitment fee likely appeals to some form of wellness value.

Value co-destruction

I’m sure that Electrolux would claim quality as another proposed value. And here is a good example of where value co-destruction might creep in. We saw earlier that the beneficiaries need to bring competence to the service. Say, for example, they misunderstand the type of surfaces where the service can be best applied, then they are likely to be disappointed. That would be a classic case of resource misuse in Lintula, Tuunanen, & Salo’s framework of value co-destruction in the in-use phase. Probably followed by complaints on social media / word of mouth in the after phase. As the beneficiary attempts a restoration of resource. This results in value co-destruction.

Now we can better understand the value proposition.

The Value Proposition

So our value proposition consists of three aspects: the progress offered to be made; the servicescape; and the potential value to the beneficiary.

We know that this value proposition is offering to help the beneficiary get a job done (as opposed to solve a problem or, directly, remove a hinderance). And that job is to remove small surface objects from a space.

As such, it is in competition with a range of options. Such as competing products, competing services (e.g. human cleaning services) and the do-nothing option.

In terms of servicescape, the service is available anytime the beneficiary wants, as the device resides in the apartment/house. There is a mobile app that enables the functionality. That should be simple to use, for all beneficiaries. As we identified above, the beneficiaries own apartment/house, as part of the servicescape, is a potential source of value co-destruction.

Offering to save the beneficiary time and reduce their effort. The beneficiary is informed the cleaning is done, can see history, and when it is scheduled next. They also get peace of mind that their surface is regularly cleaned. And if needed can easily schedule additional cleans to reduce any anxiety of unexpected company later in the day.

And we have to think of the value proposition at both the point of sale as well as all points of use (Christiansen’s big and little hires in his job to be done theory).

Electrolux’s vacuum as a service approach tackles the value proposition at both points. [to extend…] At the big sale it addresses innovation adoption aspects through lowering cost barriers and offering trialability. For the repeated little sales – choosing to use the cleaner instead of competitors – Electrolux are reducing hinderances. By, for example, sending service packs in time for use.

Where could Electrolux go next?

[being updated]

- Extend the service to new products

- Extend the target market

I’m sure this robotic vacuum cleaner is just the first toe in the water for Electrolux and for consumers. If it succeeds, there will surely be other devices following.

Can the service move into other markets? This is firmly targetted at consumer cleaning, could it work for professional cleaning? Could Electrolux re-package as a part solution, or even partner with, a professional cleaning company to incorporate it as part of its service? For example, a cleaning company may have a contract with a hotel. The robotic devices could run around all day cleaning the hallways. Whereas humans could take on the more focussed work of cleaning the bedrooms. Or maybe the human cleaner deploys the vacuum cleaner into the room as the perform all the other tasks, freeing up time that would otherwise be spent vacuuming.

Can the device be shared amongst people? A block of apartments wouldn’t necessarily need a device per apartment…It could be “hired” for the day. Or, Electrolux could horizontally expand the service by joining up with a smart lock service. That way the device could unlock and enter apartments itself.

Wrapping up

The service economy is here, it is growing, and if you want to stay a product only company, be worried. But, we know why the shift is happening. So it is a case of looking at your products and determining how to harness those reasons; wrapped in a profitable business model.

That is what Electrolux appears to be trying. Will it succeed? That remains to be seen. Consumers are a fickle bunch and there is an ecosystem of cleaning services already in place this needs to add-to or replace. Is there consumer value in have your existing human cleaning service that does many things and then paying more to use the Electrolux service for just floor cleaning? Or, are there enough consumers that don’t have an existing human cleaning service but see the value in just floor cleaning? Hopefully, these are questions Electrolux have modelled using Bass diffusion models.

It will be interesting to follow!